Temporary Rate Buydowns 101

As you try and navigate purchasing a home in 2024, it may seem like an unreachable dream with interest rates near their 15 year highs! There is good news though and that’s where temporary rate buydowns come into play! In fact, many of our clients have greatly benefited from temporary rate buydowns, which offer a...

2024 Conventional Loan Limits

Just ahead of the official announcement typically made in late November, we have the scoop on increased loan limits for conventional loans through Fannie Mae and Freddie Mac. Each year, the Federal Housing Finance Agency sets new loan limits based on the third-quarter House Price Index report. While updates to FHA and VA loan limits...

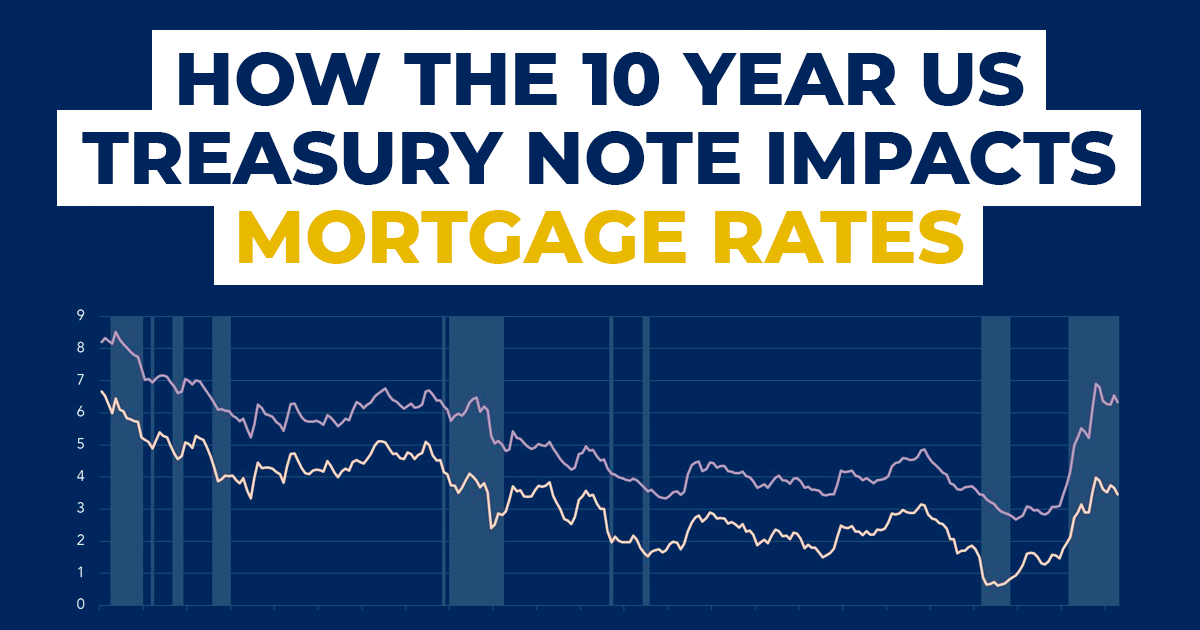

How The 10 Year US Treasury Note Impacts Mortgage Rates

For anyone getting ready to start the process of purchasing a home, you probably have done your research on loan programs, down payments, and interest rates, right? Speaking of interest rates, you may have found yourself wondering what makes interest rates what they are in the first place? Simply put, it’s the 10 Year US...

Is a Big Down Payment on a House Worth It?

Gazing into the abyss, one can understand the gravity of deciding whether to make a large down payment on a house. That’s how it can feel when pondering whether it’s worth putting a big down payment on a house. We all know that buying a home is more than just an investment. It’s setting up...

Best Neighborhoods in Gilbert, AZ

Discovering the Best Neighborhoods in Gilbert, AZ can be a thrilling journey. Many find themselves stumped when attempting to locate the ideal community to call home. In this blog post, we are going to explore some of the Best Neighborhoods in Gilbert, AZ. You may be unsure where to start. But that is okay, as...

Understanding The Real Costs of Buying a House

Most potential homebuyers fail to consider the overall costs of buying a home, while they may take into consideration some of the basics like overall purchase price and the down payment needed. However, there are several additional expenses related to buying and owning a home that prospective buyers often overlook and should take into account. We’ll...

Mortgage FICO Score vs Credit Monitoring Apps

Comprehending the nuances of credit scoring can be a perplexing and confounding experience for homeowners, buyers, and real estate professionals. With various major scoring models in use today, such as FICO Score 5, 4, or 2 for mortgage lenders and VantageScore for credit monitoring apps, it is essential to comprehend how these systems work together....

1% Down Conventional Loan Program

In the continuously shifting landscape of economical home ownership solutions, it is essential for prospective homeowners, existing owners and real estate professionals to stay up-to-date on new initiatives that could help tackle the housing affordability issue. One great new program is the Conventional 1% Down Program, which offers a unique opportunity for borrowers to achieve...

7 Mortgage Myths that Every First Time Homebuyers Need to Know

Chewing gum takes 7 years to digest if swallowed. Carrots improve your eyesight. The Great Wall of China is visible from space. (wait… is it?!) Most myths are harmless. Unfortunately, the same can’t be said for most mortgage myths. At best, they’re slightly misleading. And at worst, they lead you down an even more confusing...

Are You Ready to Buy Your First Home?

As a local mortgage broker, It’s a question we hear a lot. And trust us, we get it – if this is your first time purchasing a home, the entire process can seem intimidating. Maybe you’re feeling uncertain about where to begin, questioning whether your credit score is sufficient, or second guessing whether purchasing a...