The Ultimate Guide to VA Loans

Welcome to our comprehensive guide on accessing your VA loan benefit. At Price Mortgage, we believe in providing Veterans with accurate information and the resources they need to make informed decisions about homeownership. Our VA Loan specialists have extensive experience working with Veterans and is committed to providing personalized support and guidance throughout the entire...

FHA Lowers Monthly Mortgage Insurance Premiums!

Exciting news, the Federal Housing Administration (FHA) just announced a significant 30 basis point reduction in monthly mortgage insurance premiums (MIPs) for borrowers who take out FHA loans. What does that mean for you? If you’re already prequalified for an FHA loan, you’ll want to give us a call to get an updated approval and...

Reverse Mortgages: Everything You Need to Know

If you are a homeowner age 62 or older and are looking for a way to tap into your home’s equity to supplement your retirement income, a reverse mortgage may be worth considering. In this post, we will explore what reverse mortgages are, how they work, and the pros and cons of this type of...

Monthly Mortgage Lowdown: January 2023

In the January edition of the Monthly Mortgage Lowdown, we broke down different ways to maximize the homebuyers purchasing power! Our full discussion included:

Monthly Mortgage Lowdown: November 2022

In the November edition of the Monthly Mortgage Lowdown our main topic of discussion centered around No-doc, Non-QM, and DSCR loan programs! Our full discussion included: Mortgage Rate Update – November 29, 2022 No Doc Loans – No docs – no problems! DSCR Loans – Perfect for long-term or short-term rental properties Bank Statement Loans...

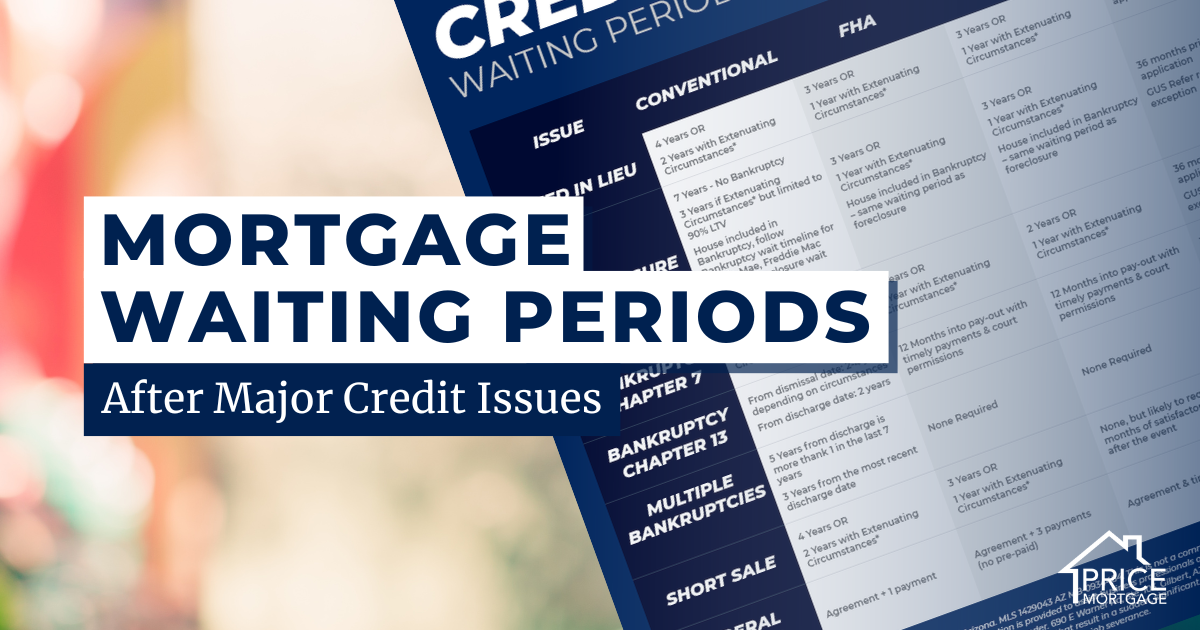

Mortgage Waiting Periods After Credit Issues

If you have had a major credit issue in the past, you may wonder how long you need to wait to buy another home. Here is some information that may help you. If you have had a bankruptcy, short sale, foreclosure, or tax lien, you may think that you won’t be able to get another...

Home Hunter TV Recap: 2/1 Buydown

Patrick McMasters recently went on The Home Hunter TV to discuss the benefits of doing a 2/1 Buydown in todays market!

Monthly Mortgage Lowdown: October 2022

In the October edition of the Monthly Mortgage Lowdown our main topic of discussion was “Pricing Strategies That Will Win You More Buyers in 2022” We had a great discussion around the following topics: Mortgage Rate Update – October 18, 2022 Year over Year Trends – Rates and Loan Values Loan Limits – Loan limits...

2/1 Rate Buydown Explained

Click here for our rate buydown calculator! In high-rate markets like we are currently seeing, affordability is key to homeowners. The 2/1 rate buydown program can be a great way for homebuyers to save money on their mortgage. This program allows buyers to lock in a lower interest rate for the first two years of...

Monthly Mortgage Lowdown: September 2022

Welcome to our new monthly webinar series where we talk about current market conditions, and showcase different products and strategies that can help save borrowers the most money as possible. For September 2022, our topic was “Finding Unique Programs That Fit Every Buyers Situation” Download the slide deck below!