Click here for our rate buydown calculator!

In high-rate markets like we are currently seeing, affordability is key to homeowners.

The 2/1 rate buydown program can be a great way for homebuyers to save money on their mortgage. This program allows buyers to lock in a lower interest rate for the first two years of their loan, and then return to the original rate for the remaining term. This can help buyers save tens of thousands of dollars over the first 24 months of the loan.

If you are considering a rate buydown, be sure to talk to your lender about the details of the program and how it will affect your payments. While this is a great way to save money on your mortgage, but it’s important to understand all the terms before you sign up.

How Does The 2/1 Rate Buydown Work?

When you lock in your rate, you’ll pay a lower rate for the first two years of your loan. This can help you save money on your monthly payments and reduce the amount of interest you’ll pay over the life of the loan. After two years, your rate will return to the original rate for the remaining term.

For the first 12 months, your rate drops by 2% below the note rate. In the second year, your rate is 1% below the note rate. After that, it returns to the original rate.

Who Pays For The 2/1 Rate Buydown?

In most cases, the seller of the home will pay for the rate buydown. Rather than coming in below offer price, the rate buydown is paid for by the seller as an incentive to attract buyers.

We do have some investors that allow us, the mortgage broker, or the real estate agents to contribute to the buydown cost as well. Please contact us for more information.

How Much Money The The 2/1 Buydown Save Me?

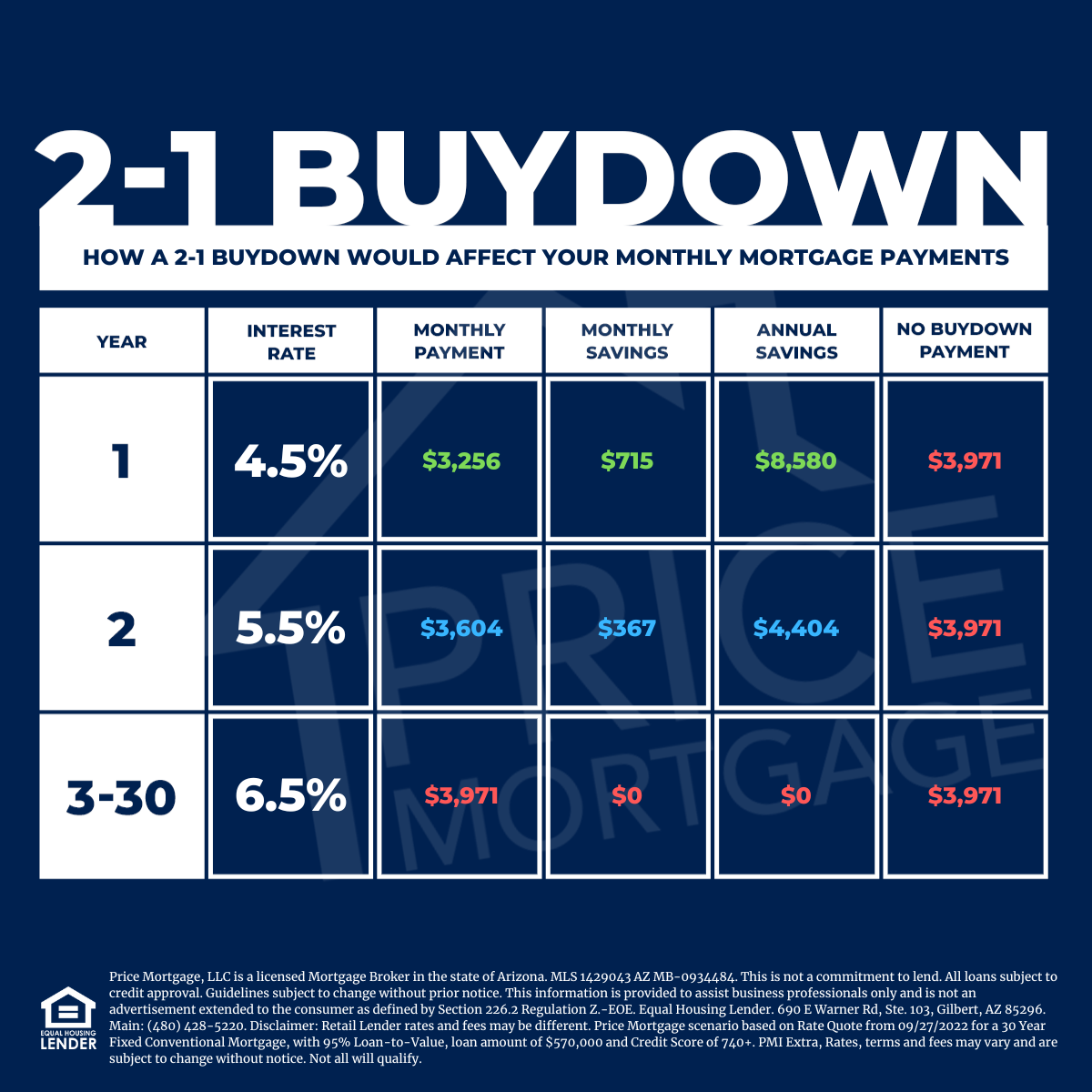

2/1 Buydown Scenario

- Purchase Price: $600,000

- Loan Amount: $570,000 (5% Down)

- Interest Rate: 6.5%(6.944% APR)

- FICO Score: 740

*NOTE: This interest rate is an example only to illustrate the savings. The market changes constantly, must call for an accurate rate. Payments below illustrate principal and interest only.

MARKET RATE:

- Payment: $3,971/mo

YEAR 1:

- Rate: 4.5%

- Payment: $3,256/mo

- Monthly Savings: $715/mo

- Annual Savings: $8,580

YEAR 2:

- Rate: 5.5%

- Payment: $3,604/mo

- Monthly Savings: $367/mo

- Annual Savings: $4,404

The total savings over the first 24 months? $12,984!

To put that into perspective, to get the same payment as the first 12 months on the buydown, you would have to offer $485,000 for the home. Or put another way… $115,000 under listing price!

Sellers may be willing to negotiate, but probably not by that much! Instead, the buydown only costs the seller $12,984 in concessions and they still sell their home at asking price!

Can I Refinance Before the Buydown Period Ends?

Yes! In fact, if you refinance before the buydown period ends, you will also be refunded the remaining savings. The total cost of the buydown is set aside into an escrow account that get’s drawn monthly to cover the monthly buydown savings, so if you pay off your loan or refinance within the buydown period you get whatever is left over!

Is a 2/1 Buydown Better Than a Permanent Buydown?

This depends on your personal situation.

If you believe that rates will likely go down within 24 months, the 2/1 rate buydown makes more sense because you’re planning on refinancing to a lower rate in the near future.

However, if you don’t think rates will go up or stay the same, and you plan on staying in your home for more than two years, then a permanent rate buydown may be the better option. With a permanent rate buydown, your rate is lower for the entire life of the loan.

If you’re not sure which option is best for you, please contact us and we can help you compare the two rate buydown programs. We can also provide you with current rate quotes so that you can make an informed decision about which option is best for your needs.

Not Sure Where To Start?

That's okay. Let us build a custom loan program around your needs and budget.

Contact Us