Comprehending the nuances of credit scoring can be a perplexing and confounding experience for homeowners, buyers, and real estate professionals. With various major scoring models in use today, such as FICO Score 5, 4, or 2 for mortgage lenders and VantageScore for credit monitoring apps, it is essential to comprehend how these systems work together.

In this comprehensive review on different scoring models, we will dive into the factors affecting mortgage scores like payment history and outstanding debt. Additionally, we’ll discuss strategies for improving your mortgage score to secure better loan opportunities. As you navigate multiple credit-scoring systems effectively by recognizing key differences among popular models (FICO vs VantageScore), you’ll learn how to interpret and analyze credit reports from various sources.

Finally, we will guide you through preparing for the mortgage application process by gathering necessary financial documentation and researching potential lenders with their specific requirements. This knowledge will empower you in assessing affordability based on your current income levels while maximizing your chances of success when applying for a home loan.

Different Scoring Models in Credit Monitoring Apps and Mortgage Lenders

Don’t be fooled by your credit score on a credit monitoring app such as Credit Karma, as mortgage lenders use different scoring models that can result in lower scores and impact your ability to secure a loan.

Understanding Credit Score Variations Between Apps and Lenders

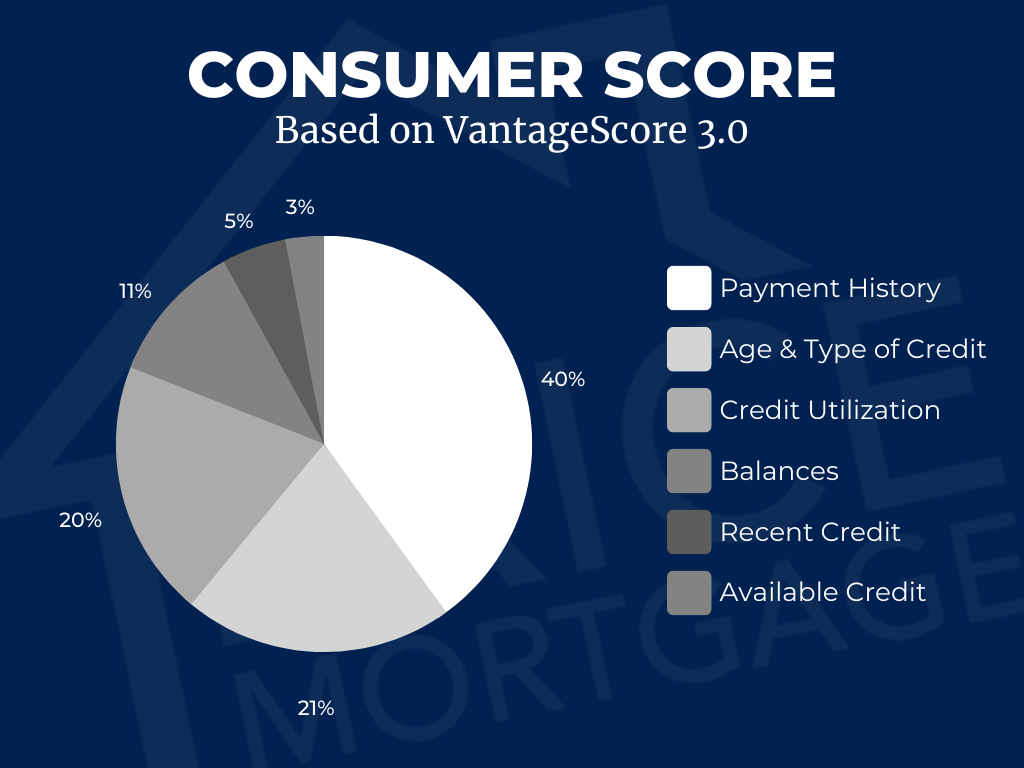

Credit monitoring apps use VantageScore, while mortgage lenders rely on FICO Scores, which can lead to significant variations in scores and borrowing potential.

How FICO Score 5, 4, or 2 Are Used by Mortgage Lenders

Mortgage lenders use specific FICO Scores that place more emphasis on payment history and outstanding debt relative to other types of loans, so don’t assume excellent scores on an app will guarantee similar results with mortgage-specific FICO Scores.

The Role of VantageScore in Credit Monitoring Apps

VantageScore provides a useful snapshot of overall credit health, but may not accurately represent how mortgage lenders view your application due to differences in how factors are weighed.

To improve your chances of securing a loan, familiarize yourself with the specific criteria evaluated by each system and work on improving key factors such as payment history and outstanding debt.

While it’s not always the case, most people are shocked to see that their actual FICO score is less(sometimes significantly less) than the score being reflected in their credit monitoring app.

Factors Affecting Mortgage Scores

Several factors affect mortgage scores beyond credit history, so let’s dive in.

Payment History: The Key to Your Mortgage Score

Timely payments across all accounts demonstrate financial responsibility and reliability, so pay your bills on time and set up automatic payments.

Outstanding Debt: Affecting Your Borrowing Potential

High levels of debt relative to available credit limits(credit utilization) may signal financial strain and reduce your borrowing potential, so keep balances low on revolving lines of credit and work towards reducing other forms of debt.

Length of Credit History: A Determining Factor

A longer credit history typically results in higher mortgage scores, so avoid closing old accounts and be cautious when opening new lines of credit.

Other Factors Influencing Mortgage Scores

Credit mix, new credit inquiries, and public records can also impact your mortgage score, so maintain a diverse range of credit types, avoid frequent applications for new credit, and steer clear of bankruptcies or tax liens on your record.

Grasping these elements can assist you in enhancing your financial standing and obtain more advantageous loan arrangements from potential creditors.

Boost Your Mortgage Score for Better Loan Opportunities

Improve your financial health and increase your chances of securing favorable loan terms with these tips for boosting your mortgage score.

Reduce Outstanding Debts

Prioritize high-interest loans and consider debt consolidation to lower interest rates.

Make Timely Payments

Paying bills promptly, arranging automated payments, and avoiding penalties are all important steps to take.

Build Positive Credit

- Diversify: Have various types of credit accounts to demonstrate responsible borrowing habits.

- Increase Limits: Request higher limits on existing lines of credit to reduce utilization ratios.

- Open New Accounts: Apply for a secured credit card to establish positive payment patterns.

Having a better mortgage score can not only lead to more beneficial loan terms, but it also helps ensure financial soundness.

Navigating Multiple Credit Scoring Systems Effectively

Don’t get lost in the maze of credit scoring systems – stay informed and manage your finances wisely.

Recognizing Key Differences Among Popular Scoring Models

Understand the unique methodologies of popular scoring models like FICO and VantageScore to navigate them effectively.

Interpreting and Analyzing Credit Reports from Different Sources

Review credit reports regularly for accuracy and discrepancies, analyzing account balances, reviewing account statuses, and identifying errors.

- Ensure reported amounts align with actual balances owed.

- Confirm open/closed status and payment history for accuracy.

- Dispute any incorrect information with the reporting agency to improve your score.

The Importance of Monitoring Your Credit Score Regularly

Keep a watch on your credit rating and pinpoint any areas that need enhancement prior to submitting an application for a loan.

Use free resources to track your scores from both FICO and VantageScore models, and consider signing up for credit-monitoring services or apps that provide real-time alerts about changes in your credit report.

Get Mortgage-Ready: Tips for a Smooth Application Process

Understanding the difference between mortgage scores and credit monitoring apps is key to securing favorable loan terms, but preparation is also crucial. Here are some essential steps to take before submitting your mortgage application:

Gather Your Financial Documents

Don’t get caught off guard – gather all necessary financial documents beforehand, including tax returns, pay stubs, bank statements, credit reports, and a list of debts and expenses.

Research Potential Lenders

Investigate lenders’ individual regulations and criteria before settling on one, analyzing variables such as interest rates, loan terms, and fees to determine the best option for your needs. Compare different elements, such as rates of interest, loan conditions and charges to determine the best match for your exclusive situation.

Assess Affordability

Don’t overextend yourself financially – assess affordability based on your current income and debt levels. Aim to keep your monthly mortgage payment at or below 28% of your gross income, and use online calculators to determine the amount you can afford.

By following these tips, you’ll be well-equipped to secure a favorable mortgage with confidence. Stay informed about different scoring models used by lenders and credit monitoring apps, and take proactive measures to improve your financial health throughout the homeownership journey.

Conclusion

Scoring Models can make or break your mortgage application, so it’s crucial to understand the differences between credit monitoring apps and mortgage lenders.

Knowing the factors that affect your score and the variations between popular models like FICO and VantageScore can help you navigate multiple scoring systems effectively.

Prepare for the application process by gathering necessary financial documentation and researching potential lenders to assess affordability based on your current income and debt levels.

Not Sure Where To Start?

That's okay. Let us build a custom loan program around your needs and budget.

Contact Us