Bridge Loan Mortgage Guide: Smooth Your Home Transition

You found it. The perfect house. The one with the great kitchen, the backyard you can actually use, and it is in the right school district. There is just one problem. You have to sell your current house first. This puts you in that stressful limbo of making a contingent offer and hoping the sellers...

When is the Best Time to Buy a House?

Trying to figure out the best time to buy a house can feel like you’re trying to time the stock market. It’s confusing. You hear one thing from the news and something completely different from a friend who just bought a place. Many people are on the sidelines right now, just waiting. They’re watching interest...

Refinancing for Home Improvements: What Homeowners Should Know

Thinking about finally tackling that kitchen remodel, bathroom upgrade, or dream backyard deck? Renovations can make your home more comfortable and even boost its value. But the cost is often the biggest hurdle. One option many homeowners explore is refinancing their mortgage to help pay for improvements. Refinancing may sound complicated, but with the right...

HELOC vs. Home Equity Loan in Arizona: Which Is Right for You?

Living in Arizona where home values have increased over recent years, your home might be holding onto some serious cash; it’s called home equity. A HELOC or Home Equity Loan could be your ticket to using it, especially if you need to borrow money for significant goals. You’ve probably heard about home equity lines of...

Does a Government Shutdown Delay Your Mortgage?

When you hear about a government shutdown in the news, it’s natural to wonder how it might affect your mortgage or home loan process. The good news: most mortgages continue to move forward. But there are some programs and federal verifications that can experience delays. USDA Loans: Most Affected The biggest impact tends to be...

Temporary Rate Buydowns 101

As you try and navigate purchasing a home in 2024, it may seem like an unreachable dream with interest rates near their 15 year highs! There is good news though and that’s where temporary rate buydowns come into play! In fact, many of our clients have greatly benefited from temporary rate buydowns, which offer a...

2024 Conventional Loan Limits

Just ahead of the official announcement typically made in late November, we have the scoop on increased loan limits for conventional loans through Fannie Mae and Freddie Mac. Each year, the Federal Housing Finance Agency sets new loan limits based on the third-quarter House Price Index report. While updates to FHA and VA loan limits...

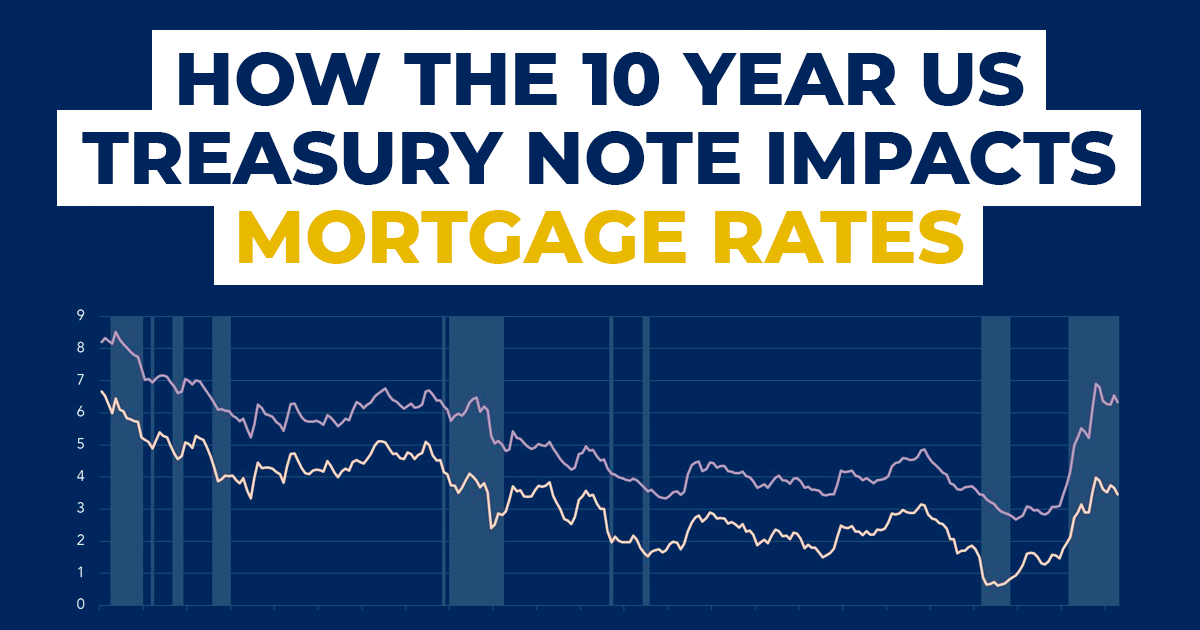

How The 10 Year US Treasury Note Impacts Mortgage Rates

For anyone getting ready to start the process of purchasing a home, you probably have done your research on loan programs, down payments, and interest rates, right? Speaking of interest rates, you may have found yourself wondering what makes interest rates what they are in the first place? Simply put, it’s the 10 Year US...

Is a Big Down Payment on a House Worth It?

Gazing into the abyss, one can understand the gravity of deciding whether to make a large down payment on a house. That’s how it can feel when pondering whether it’s worth putting a big down payment on a house. We all know that buying a home is more than just an investment. It’s setting up...

Best Neighborhoods in Gilbert, AZ

Discovering the Best Neighborhoods in Gilbert, AZ can be a thrilling journey. Many find themselves stumped when attempting to locate the ideal community to call home. In this blog post, we are going to explore some of the Best Neighborhoods in Gilbert, AZ. You may be unsure where to start. But that is okay, as...