What’s the difference between FHA, Conventional, and VA loans?

FHA loans are for first time buyers, conventional loans are for more established buyers, and VA loans are only for those that served in the military – right?

Kind of…

FHA loans are insured by the Federal Housing Administration, VA loans are insured by the U.S. Department of Veterans Affairs, while conventional loans aren’t insured by a federal agency.

All three loan programs have pros and cons for different types of buyers and scenarios, each program also has different qualification requirements. FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. VA loans are reserved for those with VA eligibility and allow lower credit scores, zero down payment options.

If you’re considering an FHA, Conventional, or VA loan consider the following factors while comparing the programs.

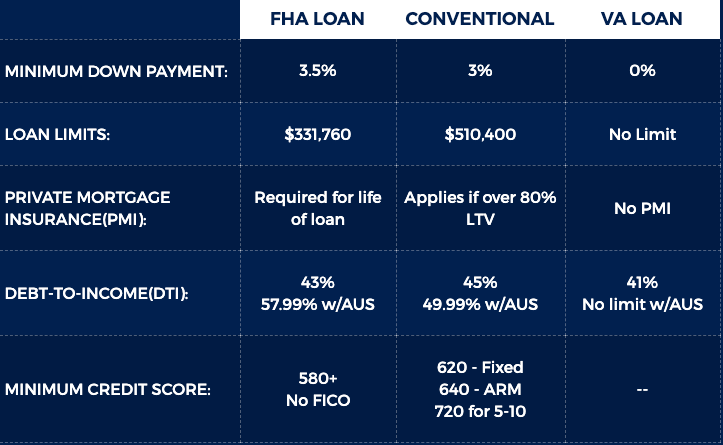

Loan Program Comparison Chart

FHA Loan |

Conventional |

VA Loan |

|

| Minimum Down Payment: | 3.5% | 3% | 0% |

| Loan Limits: | $420,680 | $647,200 | No Limit |

| Private Mortgage Insurance(PMI): | Required for life of loan | Applies if over 80% LTV | No PMI |

| Debt-To-Income(DTI): | 43% 57.99% w/AUS |

45% 49.99% w/AUS |

41% No limit w/AUS |

| Minimum Credit Score: | 580+ No FICO |

620 - Fixed 640 - ARM 720 for 5-10 |

-- |

Down Payment Requirements

FHA loans require a minimum of 3.5% down for borrowers with credit scores of 580 or greater. If you don't have 3.5% down the FHA will allow you to use gift funds from a family member as a down payment on primary residents only.

One of the biggest misconceptions with conventional loans is that everyone has to put at minimum of 20% down. This is not true, you can put down as little as 3% with certain conventional mortgages, but it's usually reserved for borrowers with good credit and ample reserves.

Although not everyone is eligible for a VA loan, VA loans offer the ability to purchase a home with 0% down. While there is no down payment requirement, there is a funding fee of 2.15% for first time buyers, which can either be rolled into the loan or paid upfront.

Minimum Credit Requirements

FHA is the easiest loan program to qualify for with its lenient credit requirements. With just a 580 FICO you can be eligible for just 3.5% down. You can still qualify for an FHA loan with a credit score as low as 500, but you'll have to put more money down.

Conventional loans typically require a minimum credit score of 620 or higher. Keep in mind that the lower your credit score is the higher your interest rate is.

The U.S. Department of Veterans Affairs, which insures all VA loans doesn't require a minimum credit score. This doesn't mean that anyone and everyone will qualify regardless of their credit score though. Certain lenders do have their own minimum credit score requirements, usually in the 580-620 range similar to FHA. Just like with all other programs, the better your score, the better your rate will be.

Loan Limits

Both FHA and Conventional loans limit the amount you can borrow, and the maximum loan size varies by county. You can find a full breakdown of the 2020 loan limits here. In Maricopa county, the FHA loan limit is $420,680, the limit for conventional loans is $647,200. If you are looking at purchasing a home greater than the max-loan limit you'll need to put more money down, or use a different type of loan, like a jumbo loan.

As of January 1, 2020 there is no loan limit for VA loans. This means you will be able to go as high as $1M+ with as little as $0 down with qualifying VA entitlements. Please note that this is not intended to be a permanent change, but is effective as the date of this posting.

Private Mortgage Insurance

Private Mortgage Insurance(PMI) is for the lenders benefit, not the homeowners benefit. PMI is an insurance policy on loans which protect the lender in the event that you default on your loan. This extra cost is rolled into your loan, which increases your monthly payment.

On a conventional mortgage you will have to pay PMI if you put down less than 20%, or the loan-to-value(LTV) ratio is over 80%. PMI is automatically canceled on conventional loans after the equity reaches 78% of the purchase price.

On an FHA loan, private mortgage insurance is required for the lifespan of the loan. You can only remove PMI on an FHA loan if you refinance to a conventional loan, assuming your LTV is under 80%.

Debt-To-Income Ratio

DTI is a key factor that lenders will use to make sure you can repay your loan and that you do not over extend yourself.

Your debt-to-income(DTI) ratio compares the amount of monthly recurring debt to your overall monthly income by dividing your minimum debt payments by your gross income. DTI only takes into account minimum debt obligations. For example, if you always pay $200 per month towards paying down a credit card but your minimum credit card payment is only $67, than only $67 is used. Keep in mind that the lender will include your new mortgage payment in your DTI calculation.

FHA loans typically cap DTI at 43%, but can go as high as 57.99% with automated underwriting system approval.

Conventional loans typically cap DTI at 45%, but can go as high as 49.99% with automated underwriting system approval.

VA loans typically cap DTI at 41%, and have no limit with automated underwriting system approval.