If you have had a major credit issue in the past, you may wonder how long you need to wait to buy another home. Here is some information that may help you.

If you have had a major credit issue in the past, you may wonder how long you need to wait to buy another home. Here is some information that may help you.

If you have had a bankruptcy, short sale, foreclosure, or tax lien, you may think that you won’t be able to get another mortgage for seven years. However, this is not always the case. While it may be more difficult to get approved for a mortgage after having one of these credit issues, it is not impossible.

There are a few things you can do to improve your chances of getting approved for a mortgage after having credit issues. First, make sure you have re-established good credit. This means making all of your payments on time, keeping your balances low, and using credit wisely. Regardless of how long you need to wait to purchase, you want to ensure that your credit is in the best possible spot when the time comes.

How long you have to wait depends on a lot of different factors such as the type of credit issue you face, the loan program, or the mortgage lender. Some mortgage lenders may require you to wait longer than others.

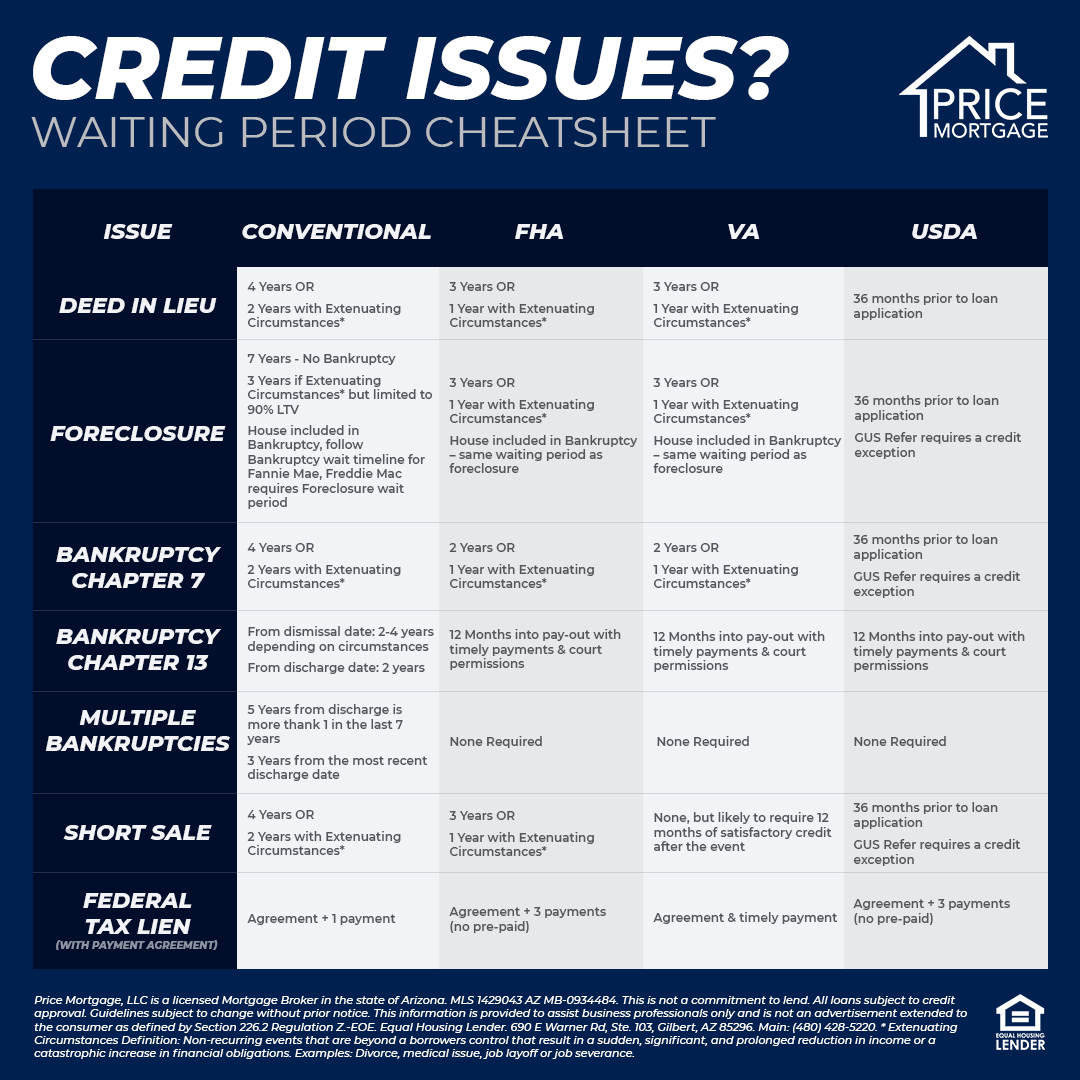

See below for some basic waiting guidelines, there may be other factors that come in to play so always make sure you consult with a licensed loan officer about your specific scenario.

Deed In Lieu Of Foreclosure Mortgage Waiting Period

A deed in lieu of foreclosure means that you voluntarily turn the property back to the mortgage lender instead of going through with a foreclosure. By going this route, the wait period and credit impact is much less severe.

Conventional Loan Waiting Period (Deed In Lieu):

- 4 Years OR

- 2 Years with Extenuating Circumstances*

FHA Loan Waiting Period (Deed In Lieu):

- 3 Years OR

- 1 Year with Extenuating Circumstances*

VA Loan Waiting Period (Deed In Lieu):

- 3 Years OR

- 1 Year with Extenuating Circumstances*

USDA Loan Waiting Period (Deed In Lieu):

- 36 months prior to loan application

Foreclosure Mortgage Waiting Period

A foreclosure means that the mortgage lender has taken back ownership of the property because you have failed to make payments. After a foreclosure, the waiting period and impact to your credit is more severe than other credit issues.

Conventional Loan Waiting Period (Foreclosure):

- 7 Years – No Bankruptcy

- 3 Years if Extenuating Circumstances* but limited to 90% LTV

- House included in Bankruptcy, follow Bankruptcy wait timeline for Fannie Mae, Freddie Mac requires Foreclosure wait period

FHA Loan Waiting Period (Foreclosure):

- 3 Years OR

- 1 Year with Extenuating Circumstances*

- House included in Bankruptcy – same waiting period as foreclosure

VA Loan Waiting Period (Foreclosure):

- 3 Years OR

- 1 Year if Extenuating Circumstances*

- House included in Bankruptcy, must use the later of the discharge date or the date of title transfer to apply the wait period

USDA Loan Waiting Period (Foreclosure):

- 36 months prior to loan application

- GUS Refer requires a credit exception

Bankruptcy – Chapter 7 Mortgage Waiting Period

A chapter 7 bankruptcy is when you have all of your debts discharged. This is the most common type of bankruptcy.

Conventional Loan Waiting Period (Bankruptcy – Chapter 7):

- 4 Years OR

- 2 Years with Extenuating Circumstances*

FHA Loan Waiting Period (Bankruptcy – Chapter 7):

- 2 Years OR

- 1 Year with Extenuating Circumstances*

VA Loan Waiting Period (Bankruptcy – Chapter 7):

- 2 Years OR

- 1 Year with Extenuating Circumstances*

USDA Loan Waiting Period (Bankruptcy – Chapter 7):

- 36 months prior to loan application

- GUS Refer requires a credit exception

Bankruptcy – Chapter 13 Mortgage Waiting Period

A chapter 13 bankruptcy is when you have a repayment plan to pay back some or all of your debts. This type of bankruptcy is less common and generally has a shorter wait period.

Conventional Loan Waiting Period (Bankruptcy – Chapter 13):

- From dismissal date: 2-4 years depending on circumstances

- From discharge date: 2 years

FHA Loan Waiting Period (Bankruptcy – Chapter 13):

- 12 Months into pay-out with timely payments & court permissions

VA Loan Waiting Period (Bankruptcy – Chapter 13):

- 12 Months into pay-out with timely payments & court permissions

USDA Loan Waiting Period (Bankruptcy – Chapter 13):

- 12 Months into pay-out with timely payments & court permissions

Multiple Bankruptcies Mortgage Waiting Period

When you have multiple bankruptcies, the wait period is generally determined by the most recent bankruptcy.

Conventional Loan Waiting Period (Multiple Bankruptcies):

- 5 Years from discharge is more thank 1 in the last 7 years

- 3 Years from the most recent discharge date

FHA Loan Waiting Period (Multiple Bankruptcies):

- None Required

VA Loan Waiting Period (Multiple Bankruptcies):

- None Required

USDA Loan Waiting Period (Multiple Bankruptcies):

- None Required

Short Sale Mortgage Waiting Period

A short sale is when the mortgage lender agrees to accept less than what is owed on the mortgage. A short sale generally has a shorter wait period than a foreclosure.

Conventional Loan Waiting Period (Short Sale):

- 4 Years OR

- 2 Years with Extenuating Circumstances*

FHA Loan Waiting Period (Short Sale):

- 3 Years OR

- 1 Year with Extenuating Circumstances*

VA Loan Waiting Period (Short Sale):

- None, but likely to require 12 months of satisfactory credit after the event

USDA Loan Waiting Period (Short Sale):

- 36 months prior to loan application

- GUS Refer requires a credit exception

Federal Tax Lien (w/Payment Agreement) Mortgage Waiting Period

When you have a federal tax lien with payment agreement, the wait period is determined by the loan type and the number of payments you have made.

Conventional Loan Waiting Period (Federal Tax Lien):

- Agreement + 1 payment

FHA Loan Waiting Period (Federal Tax Lien):

- Agreement + 3 payments (no pre-paid)

VA Loan Waiting Period (Federal Tax Lien):

- Agreement and timely payment

USDA Loan Waiting Period (Federal Tax Lien):

- Agreement + 3 payments (no pre-paid)

* Extenuating Circumstances Definition: Non-recurring events that are beyond a borrowers control that result in a sudden, significant, and prolonged reduction in income or a catastrophic increase in financial obligations. Examples: Divorce, medical issue, job layoff or job severance.

Not Sure Where To Start?

That's okay. Let us build a custom loan program around your needs and budget.

Contact Us