For anyone getting ready to start the process of purchasing a home, you probably have done your research on loan programs, down payments, and interest rates, right?

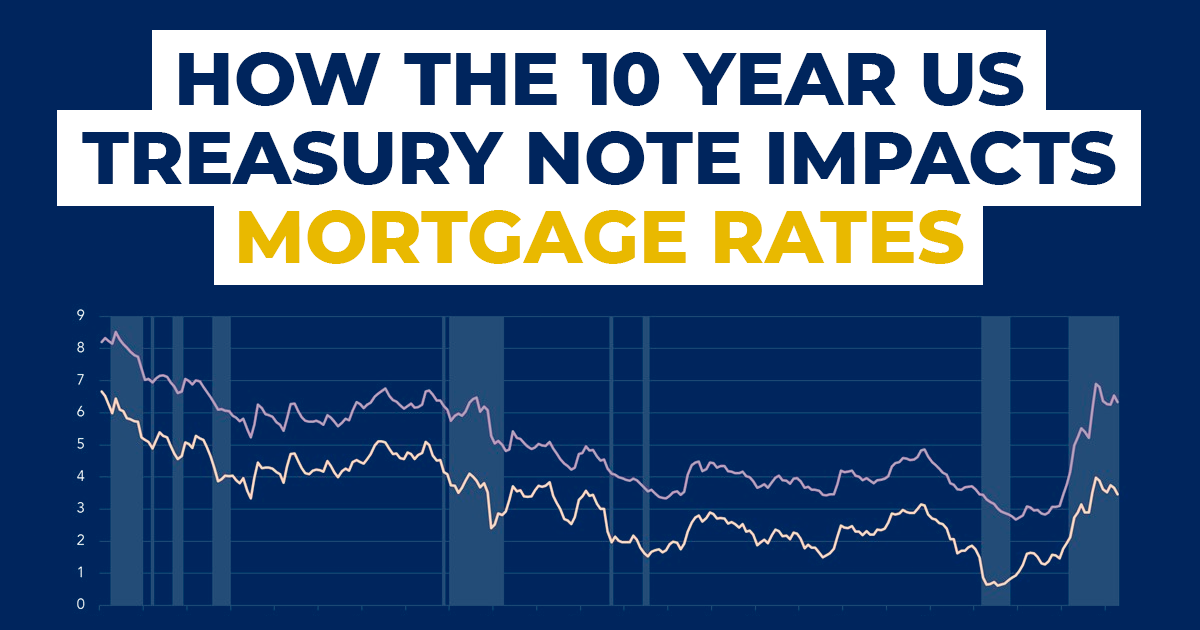

Speaking of interest rates, you may have found yourself wondering what makes interest rates what they are in the first place? Simply put, it’s the 10 Year US Treasury Note that has a large impact on mortgage rates.

This connection might seem distant or abstract, but when you’re in the market for a new home, it suddenly becomes very relevant. Below, we’ll help you understand it’s role in determining mortgage rates.

The Relationship Between Mortgage Rates and the 10-Year Treasury Note

The relationship between mortgage rates and the 10-year Treasury note is important to understand as it has a direct correlation between mortgage interest rates.

The Role of Mortgage Backed Securities in the Bond Market

Mortgage Backed Securities (MBS) are a key factor in determining mortgage rates, they involve bundling home loans purchased from lenders and selling them on the bond market. They are essentially bundles of home loans bought from lenders, grouped together, and then sold on the bond market. MBS compete with other low-risk investments like Treasury bonds.

In an attempt to attract investors, MBS must offer attractive returns or yields similar to those of their rival – Treasury bonds. As such, when treasury yield goes up or down, so do these competing investment options – including your average rate for mortgages.

Economic Indicators Reflected in the 10-Year Treasury Yield

You may wonder why everyone keeps tabs on this particular treasury yield curve rather than say a two year or thirty years? The reason is simple: they’re trying to predict economic growth trends based on market expectations.

A high demand for ten-year treasuries suggests that investors expect slower economic growth ahead; hence lower interest rates will prevail making them valuable over time. Conversely if there’s less appetite for these notes it can indicate optimism about future prospects leading towards higher interest scenarios where adjustable-rate loan options become more appealing.

Key stats are telling too. Statistically speaking, the 10-year Treasury yield and mortgage rates have had a strong correlation of about 0.85 (1 being perfect) over the last decade according to Freddie Mac data. In other words, they move together around 85% of the time.

The Inverse Relationship Between Price and Yield

One fundamental principle in the bond market is the inverse relationship between price and yield. It’s a bit like a seesaw – when one goes up, the other comes down.

The Impact of Demand for Longer-Term Treasury Bonds on Interest Rates

In this tug-of-war game, treasury bonds play an essential role. When investors’ cravings for longer-term Treasury bonds surge, it can result in considerable changes to interest rates. For instance, high demand pushes prices up while simultaneously pulling yields down (remember our seesaw?). This shift puts downward pressure on interest rates.

This concept isn’t just theoretical but is supported by concrete numbers too. According to U.S Department of The Treasury data, there has been a consistent trend showcasing this inverse relationship over several years.

Understanding these movements gives you an edge as both an investor and borrower because it helps predict where mortgage rates might be headed next. Why? Well, that’s because mortgage lenders use treasury yields as benchmarks. Hence changes here often ripple through to affect mortgage rates too.

Bond Maturities: Another Piece of the Puzzle?

Bond maturities also have their part to play in this intricacies of the financial markets – specifically how they interact with bond yield. Typically, bonds with a longer term tend to offer higher returns than those with shorter terms due to the greater risk associated over time (termed ‘time premium’). So naturally, when people buy more long-term treasuries (increasing their price), yields fall, making them less attractive relative to shorter-term bonds. And voila, we have another way that the bond market influences interest rates.

So remember, whether you’re considering investing in bonds or planning on getting a mortgage loan soon – keep an eye out for these indicators.

How Higher Yields Attract Investors

In the financial world, a higher yield often signals more profit potential. This is especially true when it comes to bonds like Treasury bonds, where an increased yield rate can draw in risk investors looking for bigger returns.

The allure of these higher yields isn’t just limited to Treasury instruments either. Corporate bonds and other types of debt securities also see greater demand when their yields rise.

Influence of Treasury Yields on Other Bond Yields

Now you might ask, how do treasury yields influence other bond yields? It’s quite simple actually. As we know, all kinds of investments compete for the same pool of money from investors.

If Treasury yields increase, then so must the rates offered by corporate and municipal issuers if they want to attract buyers. Otherwise, why would an investor take on more risk without getting compensated with a higher return?

This relationship is supported by key stat 10: over time there has been a strong correlation between movements in treasury bond yield and those seen across different types of bond markets. (source)

- Treasury Bonds: Seen as safer investments but offer lower returns.

- Corporate Bonds: Come with more risk but have potentially higher payouts due to this elevated level of uncertainty.

- Municipal Bonds: These are issued by local governments and tend to be tax-free making them attractive despite having slightly lower interest rates than corporates or treasuries.

Today’s market is indicative of this phenomenon. With treasury yields on the rise, investors are increasingly turning to corporate bonds that offer higher returns.

In essence, it’s a financial game of cat and mouse: Treasury bond yield goes up; other bond rates follow suit to stay competitive.

The Interest Rate Spread Between the 10-Year Treasury and Conforming

It’s crucial to grasp how the spread between the 10-Year Treasury and conforming mortgage rates can influence your home loan. This spread represents the difference in yield, or interest rate, on these two financial instruments.

Making Sense of The Spread

A wider spread indicates that mortgage rates are higher relative to Treasuries. It could be due to factors such as increased credit risk or anticipation of economic changes.

In contrast, a narrower spread suggests similar returns for both mortgages and Treasuries. It shows that lenders perceive less risk in lending money via mortgages than they do with purchasing government bonds.

Dynamics Behind The Spread Changes

The gap fluctuates based on several elements including inflation expectations, monetary policy shifts by the Federal Reserve (Fed), as well as supply-demand dynamics within bond markets which include both treasury bonds and mortgage-backed securities demand. On average, the margin between Treasury bonds and mortgage-backed securities is approximately 1.7 percentage points, a figure which may appear small but has an impact on loan payments.

Economic Factors Influencing The Spread

One key driver behind fluctuations in this margin includes expected future inflation levels – if investors anticipate higher inflation down the road they would require more return hence leading towards wider spreads. Monetary policies by Fed also play a significant role here, if there’s an expectation of tighter fiscal controls we tend to see increasing margins because loans become more expensive compared with treasuries since banks start hiking their lending rates.

Moreover, the state of the economy and market sentiment significantly influence this spread. In times of economic uncertainty or downturns, investors tend to flock towards safer investments like Treasuries leading to lower yields on these bonds hence narrower spreads.

Why Does This Spread Matter?

Don’t just think of the difference between the 10-year Treasury yield and conforming mortgage rate as financial jargon. It hits your wallet directly. A bigger gap might mean you’re shelling out more in interest over your loan’s lifetime than what Uncle Sam is paying.

Not Sure Where To Start?

That's okay. Let us build a custom loan program around your needs and budget.

Contact Us